Introduction

When it comes to technology investments, Apple Stock Price Prediction remains one of the most searched topics among investors worldwide. As we look toward the future, understanding Apple’s potential trajectory becomes crucial for making informed investment decisions. This comprehensive analysis explores Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050 based on current market trends, company fundamentals, and emerging technology sectors.

Apple Inc. (AAPL) has consistently been a market leader, demonstrating remarkable resilience and innovation capabilities. The company’s stock performance has been nothing short of extraordinary, making Apple Stock Price Prediction a critical topic for both retail and institutional investors.

Table of Contents

Apple’s Current Market Position

Apple stands as the world’s most valuable company by market capitalization, with a robust ecosystem encompassing iPhones, iPads, Macs, Apple Watch, and services. The company’s financial health remains exceptionally strong, with substantial cash reserves and consistent revenue growth across multiple product lines.

The tech giant’s strategic focus on services, wearables, and emerging technologies like AR/VR positions it well for future growth. Understanding these fundamentals is essential when analyzing Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050.

Apple Stock Price Prediction 2026: Detailed Monthly Analysis

Factors Influencing 2026 Predictions

Several key factors will likely influence Apple’s stock performance in 2026:

- iPhone Innovation Cycles: New iPhone models with advanced AI capabilities

- Services Growth: Continued expansion of App Store, iCloud, and subscription services

- Wearables Market: Apple Watch and AirPods evolution

- Emerging Technologies: AR/VR headset mainstream adoption

- Global Economic Conditions: Interest rates and consumer spending patterns

Monthly Apple Stock Price Prediction 2026

| Month | Predicted Price Range |

|---|---|

| January 2026 | $195 – $205 |

| February 2026 | $198 – $208 |

| March 2026 | $200 – $215 |

| April 2026 | $205 – $220 |

| May 2026 | $210 – $225 |

| June 2026 | $215 – $230 |

| July 2026 | $212 – $228 |

| August 2026 | $218 – $235 |

| September 2026 | $225 – $245 |

| October 2026 | $230 – $250 |

| November 2026 | $235 – $255 |

| December 2026 | $240 – $260 |

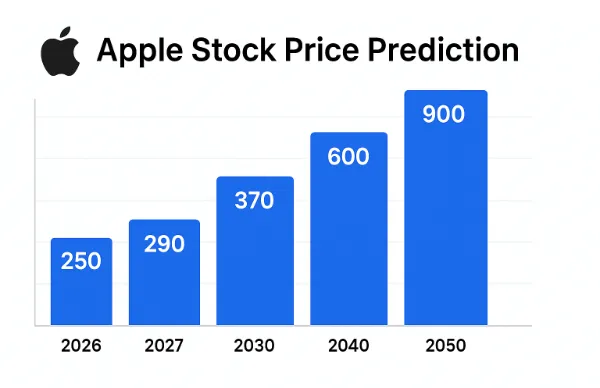

The Apple Stock Price Prediction 2026 suggests a potential 25-40% growth from current levels, driven primarily by innovation in AI and AR technologies.

Apple Stock Price Prediction 2027: Innovation-Driven Growth

2027 Market Dynamics

Apple Stock Price Prediction 2027 centers around several transformative elements:

- AI Revolution: Deep integration of artificial intelligence across all products

- AR/VR Mainstream Adoption: Second-generation Vision Pro success

- Autonomous Vehicle Progress: Apple Car development milestones

- Health Technology: Advanced health monitoring capabilities

- Sustainability Initiatives: Carbon-neutral product line completion

Also read: Top US Cryptocurrency Exchanges in 2025: Which One Is Best?

Quarterly Apple Stock Price Prediction 2027

| Quarter | Price Range | Growth Drivers |

|---|---|---|

| Q1 2027 | $250 – $275 | AI-powered iPhone features, services expansion |

| Q2 2027 | $260 – $285 | AR/VR market penetration, developer ecosystem |

| Q3 2027 | $270 – $295 | Summer product refreshes, healthcare innovations |

| Q4 2027 | $280 – $310 | Holiday season, Apple Car prototype reveals |

The Apple Stock Price Prediction 2027 indicates continued strong performance, with potential 15-20% year-over-year growth, establishing Apple’s position in next-generation computing.

Apple Stock Price Prediction 2030: The Decade Milestone

Long-term Vision Realization

Apple Stock Price Prediction 2030 reflects Apple’s evolution into multiple high-growth sectors:

- Autonomous Vehicles: Apple Car commercial launch

- Healthcare Ecosystem: Comprehensive health platform

- AR/VR Leadership: Dominant position in spatial computing

- Services Maturity: Subscription-based revenue model peak

- Global Expansion: Significant market share growth in emerging markets

Also read: Blockchain Technology Predictions 2025-2030

Apple Stock Price Prediction 2030 Analysis

By 2030, Apple’s stock could potentially reach $400-500 per share, representing a compound annual growth rate (CAGR) of 12-15% from 2026 levels. This Apple Stock Price Prediction 2030 assumes successful execution of:

- Apple Car Launch: Revolutionary autonomous vehicle platform

- Health Platform: FDA-approved medical device capabilities

- AR Glasses: Consumer-friendly augmented reality wearables

- AI Services: Advanced artificial intelligence subscription offerings

- Renewable Energy: Complete carbon-neutral operations

Apple Stock Price Prediction 2040: Technology Transformation Leader

Decade-Long Innovation Cycle

The Apple Stock Price Prediction 2040 encompasses Apple’s potential transformation into a comprehensive technology ecosystem provider:

- Neural Interface Technology: Brain-computer interaction devices

- Quantum Computing: Consumer quantum computing solutions

- Space Technology: Satellite communications and space-based services

- Biotechnology: Gene therapy and personalized medicine

- Smart City Infrastructure: Urban technology integration

Market Valuation Projections

Apple Stock Price Prediction 2040 suggests potential valuations of $800-1,200 per share, assuming:

- Successful diversification into multiple trillion-dollar markets

- Maintained technological leadership across all segments

- Global market expansion and demographic advantages

- Revolutionary product categories creating new industries

- Sustainable competitive advantages through ecosystem integration

Apple Stock Price Prediction 2050: The Next Generation

Future Technology Landscape

Apple Stock Price Prediction 2050 requires considering transformative technologies that may not yet exist:

- Post-Smartphone Era: New primary computing platforms

- Artificial General Intelligence: Advanced AI integration

- Biotechnology Convergence: Human-technology integration

- Climate Technology: Environmental restoration solutions

- Space Commercialization: Extraterrestrial technology services

Long-term Valuation Framework

The Apple Stock Price Prediction 2050 could see valuations of $1,500-2,500 per share, based on:

- Multi-Industry Leadership: Dominance across technology, healthcare, transportation, and energy

- Global Demographics: Serving 8+ billion global consumers

- Technology Integration: Seamless human-technology interfaces

- Sustainable Innovation: Environmental and social impact leadership

- Economic Evolution: Adaptation to post-digital economy structures

Risk Factors and Considerations

Market Risks Affecting Apple Stock Price Prediction

Several factors could impact these Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050 projections:

Short-term Risks (2026-2027):

- Economic recession or inflation pressures

- Increased competition from Android manufacturers

- Supply chain disruptions

- Regulatory challenges in key markets

- Consumer spending pattern changes

Medium-term Risks (2030):

- Technological disruption from unexpected innovations

- Geopolitical tensions affecting global markets

- Climate change impact on operations

- Currency fluctuation effects

- Market saturation in developed countries

Long-term Risks (2040-2050):

- Fundamental technology paradigm shifts

- New competitor emergence

- Regulatory changes in AI and biotechnology

- Social acceptance of advanced technologies

- Global economic system transformations

Also read: Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050

Investment Strategies Based on Apple Stock Price Prediction

Conservative Approach

For risk-averse investors, the Apple Stock Price Prediction suggests:

- Dollar-cost averaging: Regular monthly investments

- Dividend reinvestment: Compound growth through dividend programs

- Long-term holding: 10+ year investment horizons

- Diversification: Apple as part of broader tech portfolio

- Risk management: Position sizing appropriate to risk tolerance

Aggressive Growth Strategy

Growth-focused investors might consider:

- Timing market cycles: Strategic entry points during corrections

- Options strategies: Leveraging predicted price movements

- Concentrated positions: Higher allocation to Apple stock

- Growth catalyst focus: Investing around product launch cycles

- Technology trend alignment: Positioning for emerging technology adoption

Competitive Landscape Analysis

Key Competitors Impact on Apple Stock Price Prediction

Understanding competition is crucial for accurate Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050:

Current Competitors:

- Google/Alphabet: Android, cloud services, AI

- Microsoft: Cloud computing, productivity software, hardware

- Samsung: Mobile devices, semiconductors, displays

- Amazon: Cloud services, voice assistants, retail

- Meta: Social media, VR/AR, metaverse

Emerging Competitors:

- Chinese Tech Giants: Xiaomi, Huawei, ByteDance

- AI Startups: OpenAI, Anthropic, specialized AI companies

- Automotive Companies: Tesla, traditional automakers

- Biotechnology Firms: Healthcare technology companies

- Cryptocurrency/Web3: Blockchain-based technology platforms

Technology Trends Influencing Predictions

Artificial Intelligence Integration

AI represents a major factor in Apple Stock Price Prediction across all timeframes:

2026-2027: Basic AI features in consumer products 2030: Advanced AI personal assistants and automation 2040: AI-driven product development and customer service 2050: Artificial General Intelligence integration

Sustainability and Environmental Impact

Environmental considerations increasingly influence Apple Stock Price Prediction:

- Carbon Neutrality: Complete renewable energy transition

- Circular Economy: 100% recycled materials usage

- Environmental Restoration: Technology for climate change mitigation

- Sustainable Manufacturing: Zero-waste production processes

- Green Technology Leadership: Environmental technology innovations

Global Market Expansion Opportunities

Emerging Markets Impact on Apple Stock Price Prediction

Asia-Pacific Growth:

- India: Massive middle-class expansion

- Southeast Asia: Rising consumer technology adoption

- China: Despite challenges, significant market potential

- Japan: Aging population technology needs

- Australia: High-income market expansion

Other Regions:

- Latin America: Growing smartphone and services adoption

- Africa: Mobile-first technology leapfrogging

- Middle East: High-income consumer markets

- Eastern Europe: Technology infrastructure development

Also read: Top 10 Mistakes Every Beginner Makes When Entering the U.S. Stock Market in 2025

Financial Analysis Framework

Valuation Metrics for Apple Stock Price Prediction

Traditional Metrics:

- Price-to-Earnings (P/E): Historical and forward ratios

- Price-to-Sales (P/S): Revenue multiple analysis

- Price-to-Book (P/B): Asset valuation comparison

- Dividend Yield: Income generation potential

- Free Cash Flow: Operational efficiency measurement

Growth Metrics:

- Revenue Growth Rate: Year-over-year sales increases

- Earnings Growth: Profit expansion trends

- Market Share Evolution: Competitive position changes

- Total Addressable Market: Opportunity size analysis

- Return on Investment: Capital allocation efficiency

Frequently Asked Questions

What factors most influence Apple Stock Price Prediction 2026?

Apple Stock Price Prediction 2026 is primarily influenced by iPhone innovation cycles, AI integration, services growth, AR/VR adoption, and overall economic conditions. New product launches and quarterly earnings results will create significant price movements throughout 2026.

How reliable are long-term Apple Stock Price Prediction 2030, 2040, 2050 forecasts?

Long-term Apple Stock Price Prediction becomes less precise due to technological uncertainties, competitive changes, and economic evolution. However, Apple’s strong fundamentals, innovation history, and ecosystem approach provide a foundation for positive long-term outlook, though actual prices may vary significantly from predictions.

Should investors buy Apple stock based on these Apple Stock Price Prediction forecasts?

Apple Stock Price Prediction should be one factor among many in investment decisions. Investors should consider their risk tolerance, investment timeline, portfolio diversification, and conduct additional research before making investment decisions based solely on price predictions.

What are the biggest risks to Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050?

Major risks include economic recessions, increased competition, regulatory challenges, technological disruption, supply chain issues, and changes in consumer preferences. Geopolitical tensions and currency fluctuations also pose significant risks to international operations.

How does Apple’s dividend policy affect Apple Stock Price Prediction?

Apple’s dividend payments provide steady income streams and demonstrate financial stability, which supports stock price stability. Dividend growth often correlates with stock price appreciation, making dividend policy an important factor in long-term Apple Stock Price Prediction.

Investment Recommendations

Short-term Strategy (2026-2027)

For investors focused on Apple Stock Price Prediction 2026 and Apple Stock Price Prediction 2027:

Buy Signals:

- Stock price corrections of 10-15% from peaks

- Strong quarterly earnings beats

- Successful new product launches

- Positive analyst upgrades and price target increases

- Market-wide technology sector improvements

Hold Indicators:

- Steady earnings growth within expectations

- Market-inline product reception

- Stable competitive positioning

- Consistent dividend payments and buyback programs

- Reasonable valuation metrics compared to peers

Long-term Strategy (2030-2050)

For investors considering Apple Stock Price Prediction 2030, 2040, 2050:

Investment Thesis Validation:

- Successful diversification into new product categories

- Maintained technological leadership and innovation

- Strong ecosystem growth and user retention

- Financial metric improvement trends

- Market share expansion in key segments

Risk Management:

- Portfolio diversification across technology sectors

- Regular investment strategy review and adjustment

- Monitoring of competitive landscape changes

- Economic and regulatory environment assessment

- Technology trend alignment verification

Conclusion

The Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050 analysis reveals significant growth potential driven by innovation, market expansion, and technological leadership. While Apple Stock Price Prediction 2026 suggests steady growth through AI and AR adoption, longer-term predictions show exponential potential through diversification into automotive, healthcare, and emerging technologies.

Apple Stock Price Prediction 2027 indicates continued momentum as new product categories mature and services revenue expands. The Apple Stock Price Prediction 2030 milestone represents Apple’s evolution from a consumer electronics company to a comprehensive technology ecosystem provider.

Looking further ahead, Apple Stock Price Prediction 2040 and Apple Stock Price Prediction 2050 depend heavily on Apple’s ability to lead technological revolutions and adapt to changing consumer needs. While these long-term predictions carry greater uncertainty, Apple’s track record of innovation and financial strength provides a foundation for optimism.

Investors should view these Apple Stock Price Prediction forecasts as potential scenarios rather than guaranteed outcomes. Successful investing requires continuous monitoring of company fundamentals, market conditions, and competitive dynamics alongside price prediction analysis.

The comprehensive Apple Stock Price Prediction 2026, 2027, 2030, 2040, 2050 framework presented here provides a foundation for investment decision-making, but individual circumstances, risk tolerance, and investment objectives should ultimately guide specific investment choices.

Remember that all Apple Stock Price Prediction forecasts involve uncertainty, and past performance does not guarantee future results. Diversification, thorough research, and professional financial advice remain essential components of successful investment strategies.

Whether focusing on Apple Stock Price Prediction 2026 for near-term gains or considering Apple Stock Price Prediction 2050 for generational wealth building, Apple’s combination of innovation capability, financial strength, and market position makes it a compelling long-term investment consideration for many portfolios.